Welcome to our Monthly North Shore wrap for April. To view the full report click here.

After a longer than expected break I’m back on deck 100% and rearing to go, well nearly. Still recovering from a really bad shoulder dislocation and a terrible case of the deadly man-flu, plus the school holidays, Easter and a week away on school camp and all of a sudden 4 weeks have passed since our last update! Amazing how time flies.

During our time away Capital Gains Tax was dropped, and so was the OCR, great news for the property market which in all respects has pretty much continued as we left it a month ago, albeit I.’m going to say it’s better. Everything is still down on the Shore, but not as far down lately it seems. Plus these two changes should renew a little bit of confidence into the market going forward, especially CGT as that was very much an unknown causing many people to sit on their hands. Will we see any immediate effect? Doubtful, but already conversations at least, seem a lot more positive.

In This Week’s Market Wrap

– REINZ April Report & Market Performance

– Current Market Forces

– Listings & Stock Availability

– Auction Results & Stats

– Coming Soon

Market Performance

Median Prices – Well on the face of it, the median on the

North Shore is actually up .1% compared to March last year. But as we

know month to month comparisons don’t mean a great deal. Comparing the

past 6 month period vs the same period a year ago, prices are down

-5.8%. On a positive note as I said last month, they don’t appear to be

getting any lower.

Across Auckland the median was low and behold – $850,000. Gosh you’d almost believe it’s rigged. For 38 months in a row now the Auckland median has been around $850,000 +/- about 3%. 15 of those months the median was actually $850 something. Fair to say – prices are pretty stable across Auckland as a whole.

Volume of Sales – This is still where the big change is, and it doesn’t appear to be letting up and this is the dramatic shift in the market as mentioned previously. It’s not that prices have fallen it’s more the volume of sales. On the shore, down -19.1% compared to a year ago, and Auckland -16.3%. On a positive note if I can find one for the Shore, it’s the first month this year that volume falls have been less than 20%, and over the past quarter the rate of decline has gradually been getting lower and lower.

Hopefully with a bit of confidence restored in the market by way of no CGT, we will see volume begin to rise (or at least stop falling!). Again though this is a nationwide issue, with the volume across NZ down -11.5%.

Days on Market – 37 days on the Shore!!!! The first time this year we’ve seen a 3 in front of this number. And I would agree from what we have been seeing recently in the market, new listings do appear to be moving. Also some of the older stock, that had been on for a while and was finally selling earlier this year (which was distorting the numbers) has now sold, or been removed from the market.

The last 3 properties we have sold have all been under 20 days, and it’s been a really mixed bag of as well but overall, new stock marketed well, seems to be going a little better. Old stock unfortunately is still suffering and anything remotely overpriced isn’t going anywhere.

Current Market Forces

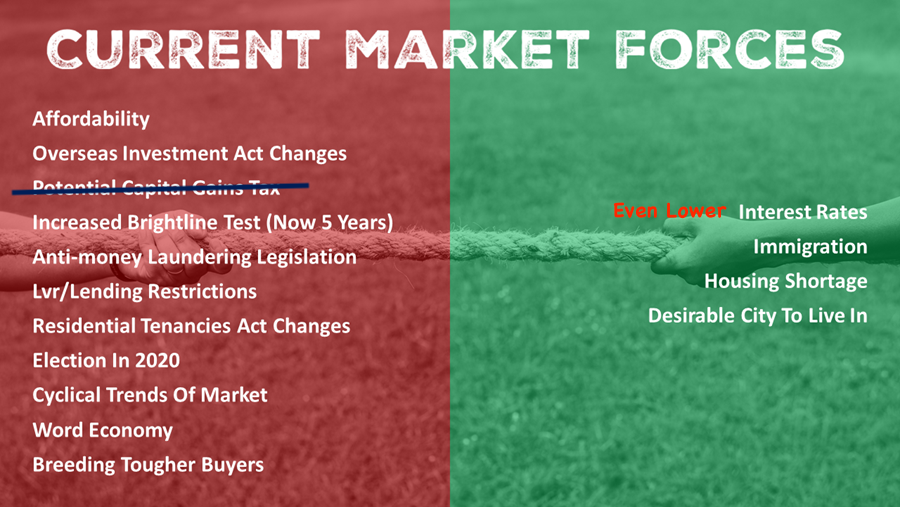

We showed this last month – but it’s nice to take something from the red column and add a win to the green. If you missed it, this shows a variety of favourable & unfavourable factors that continue to affect the property market resulting predominantly in a notable reduction in sales volumes. Some of these factors are illustrated below:

Despite low interest rates, the legislative changes and difficulty obtaining finance continue to restrain sales volumes. Hopefully, now with Capital Gains Tax taken off the table, we will see volumes rise.

Listings & Stock Availability

The

total number of property available on realestate.co.nz on the North

Shore this morning, 1759 properties. This is over 100 less than the

month prior which is expected, and great, as we head into winter.

So many Vendors tout winter as a bad time to sell – but at the same time it can be great as you have less competition as these number indicate. During the summer months there was over 1900 properties on the market on the North Shore and to be honest, it was a nightmare from sales perspective as the volume didn’t change. Great for buyers with loads of choice, but certainly no fun for the majority of Vendors.

Throughout winter people still need to buy, but options are limited and therefore it can work in the favour of Vendors.

Auction Results

Over the past 4 weeks, since my last report, Harcourts have called 66

auctions and sold 39% of those under the hammer. For the month of

April a further 14% were sold in the 14 days following giving us a

success rate of about 53%. Then as I understand it another 10-15%

percent were put under offer during that 14 day period and then

eventually sold so that’s 65-70% either sold or under contract within

the median timeframes – there or thereabouts. It’s not that bad – it’s

been worse!

No combined results this month as B&T didn’t actually post any results over the school holiday period so we don’t have the past 4 weeks of data for them at the moment.

Coming Soon

Campbells Bay – A stunning near new 4 bedroom family home.

Takapuna – A cute unit in central

Takapuna – the perfect bolt hole or starter package

Pinehill – An entertainers dream and family home – keep an eye out for this one!

Takapuna – A fantastic 3 bedroom townhouse (Available Off Market – please inquire)

Browns Bay – 2 houses on freehold sites, and some land

Northcote – A super cute 3 bed bungalow

Sunnynook – A full blown do up – or a blow up – great site though!

Forrest Hill – A very tidy renovated 3 bed 2 bath

That’s it from me. If you have any questions as always just give me a call, otherwise we look forward to seeing you out and about this weekend!

Leave a Comment